- Belgium's share of GPCA exports to Europe has more than doubled since 2002.

- Gulf states' chemical exports rose from $7 billion in 2002 to $52.7 billion in 2012.

- Europe received $8.4 billion or 15.9% of Gulf states' chemical exports in 2012.

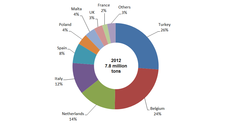

- Turkey and Belgium account for half of these exports to Europe, with 26% and 24% respectively.

Belgium's Role in Chemical Distribution

Belgium has emerged as the primary European distribution hub for chemicals from the Middle East, as highlighted in a 2013 report by the Gulf PetroChemical Association (GPCA). Belgium's share of GPCA exports to Europe has more than doubled since 2002.

Gulf States' Chemical Industry Growth

The report compiles data from Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates, along with information from the Gulf Cooperation Council (GCC). It quantitatively analyzes the chemical industry's impact in the Gulf region, considering factors like GDP contribution, production capacity, product applications, import and export volumes, added value, and job creation.

Export Figures and Market Distribution

Over the past decade, Gulf states have become significant petrochemical production centers. Their total chemical product exports increased from $7 billion in 2002 to $52.7 billion in 2012. Asia remains the largest market, while Europe is the second, receiving $8.4 billion or 15.9% of total Gulf state exports in 2012. This volume represents 7.8 million tonnes, a 280% increase compared to 2002. Turkey and Belgium together account for half of these exports to Europe, with 26% and 24% respectively.

Antwerp's Strategic Importance

The port of Antwerp, home to Europe's largest integrated petrochemical cluster, plays a crucial role in this distribution network. Antwerp's service providers are known for their expertise and safety in chemical logistics, and the port's central location further enhances its strategic importance. This is evidenced by the impressive liquid bulk volume handled by the port in 2013.