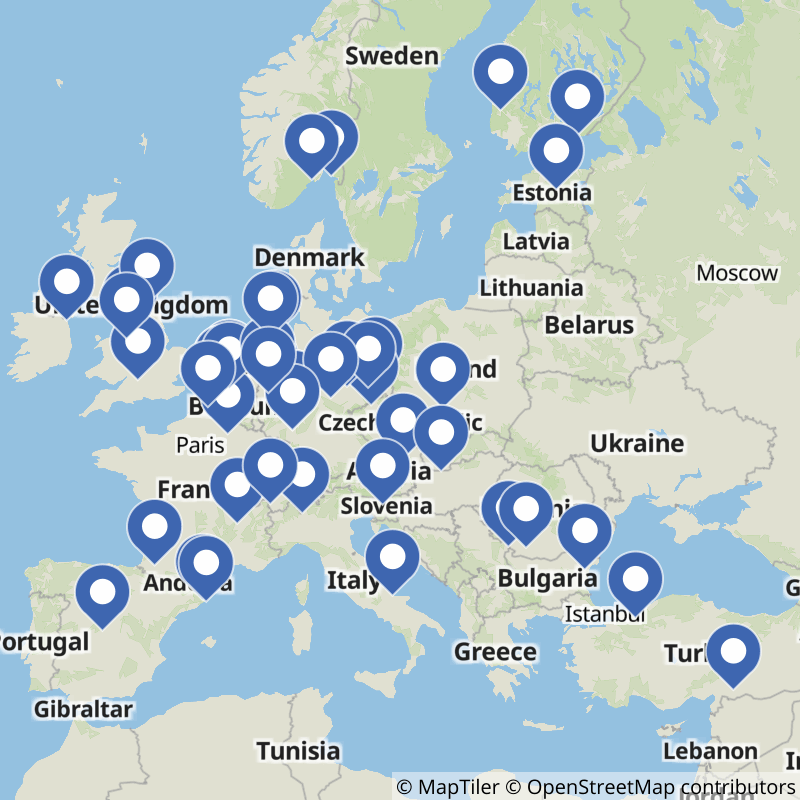

This report presents a visual overview of developments in the European chemical industry in 2022, highlighting new construction and expansion projects. It details the involved companies, target substances, and countries where these developments took place.

New plants and plant expansions in 2022 across Europe.

Plant and project location data provided by chemXplore Analytics.

Each project is labeled with one or more categories or sectors based on their target chemical processes. As can be seen from the chart, biobased & circular and energy related investments clearly outnumber other categorie in 2022.

A estimated total of 49 projects were completed.

Find out more details with chemXplore Analytics.

Number of projects that target the production of these chemical substances. In addtion to targeting the production of substances, there are also 3 projects aiming to capture & store carbon dioxide (CCS).

Most targeted substances include Carbon dioxide, Biodiesel, Ethylene, Propylene, PET, Polypropylene, Polystyrene, Acrylonitrile butadiene styrene, Sodium bicarbonate, and Hydrogen.

Many projects are located on a chemical park or cluster. This is the top 5 with the highest number of projects completed in 2022:

Industriepark Höchst, Ghent Industrial zone, BASF SE, Ludwigshafen, Port Of Antwerp, Chempark Leverkusen Currenta, Chempark Dormagen, and Chemical Cluster Delfzijl.

Companies awarded contracts for design, engineering or construction (FEED, EPC, EPCI) of the projects, sorted by number of projects:

The average investment value per project.